Smart Home Trends 2025 | What Georgia Buyers Expect in Tech-Enabled Homes

If you’re wondering what today’s buyers are looking for in a home and how that affects your listings in Cherokee County and across Georgia the answer is increasingly: smart home readiness. Homes that incorporate seamless tech, energy-efficiency, and whole-home automation are no longer just “nice to have.” They’re influential in buyer decision-making and can make your listings stand out. intro Here

🏡 Cherokee County Market Balancing in Q3 2025

Cherokee County’s real estate market is shifting toward balance. Inventory is up, prices are steady, and homes are taking a little longer to sell. See what Q3 2025 reveals for buyers and sellers in North Metro Atlanta. the intro Here

What Are the Biggest Mistakes Georgia Sellers Make When Selling a Home?

When it comes to selling your home in Georgia, avoiding common mistakes can save you time, money, and stress. The good news? Once you know what these pitfalls are, you can steer clear of them and set yourself up for a smooth, successful sale.

We are Greg and Jacquee Hart with Hart Realty Partners, and we help homeowners across Cherokee County and North GA buy and sell with confidence. Here are the five biggest mistakes we see sellers make, and how you can avoid them.

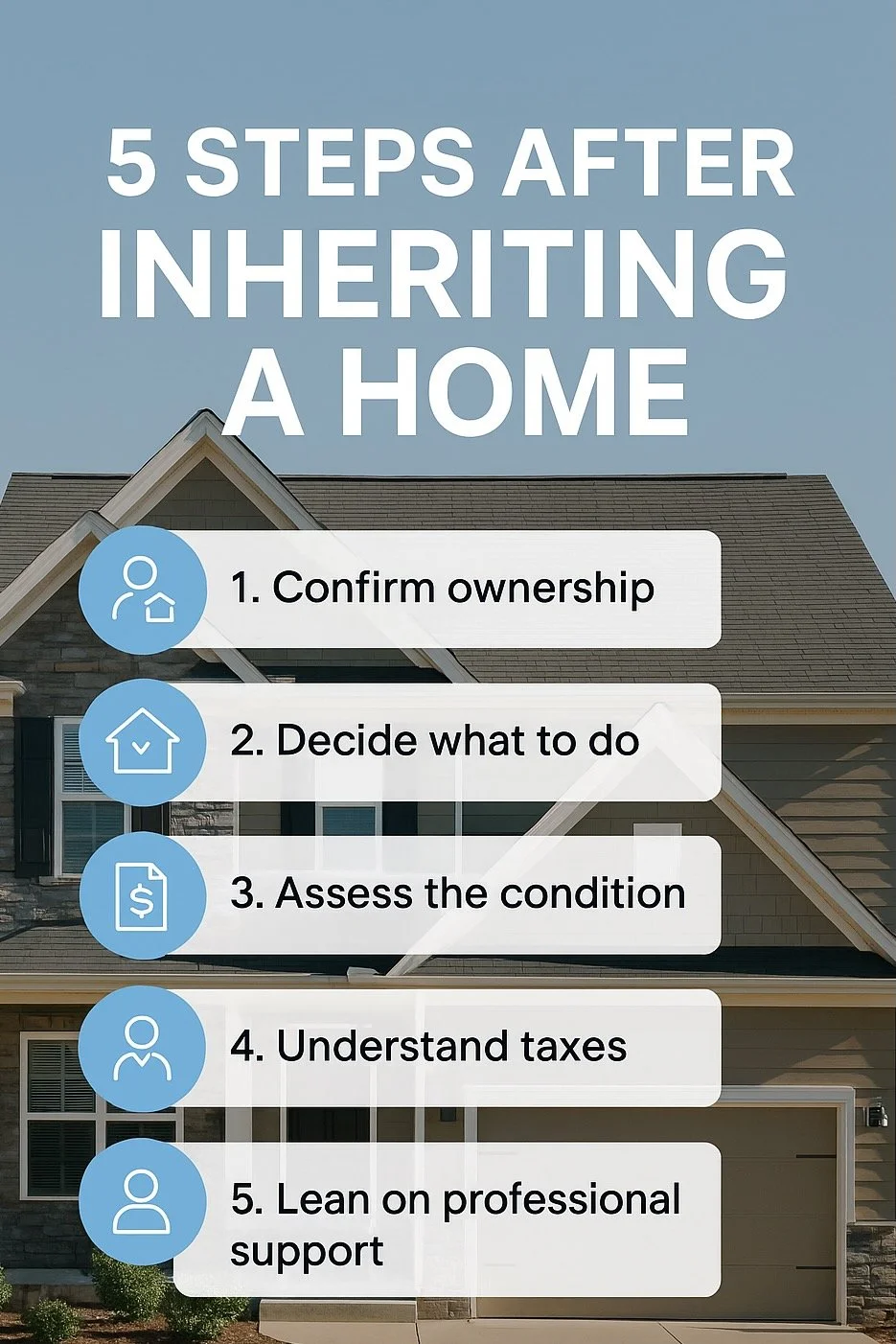

Inherited a Home in Georgia? Here’s What to Do Next

Inheriting a home can feel like both a gift and a challenge. On one hand, it’s a valuable asset. On the other, it often comes with tough decisions and emotional weight. If you’ve inherited a home in Georgia, here are the most important steps to help you move forward with clarity.

Relocating for Work? How to Sell Your Home in North Georgia Quickly

How Can You Sell Your Home Fast When Relocating for Work in North Georgia?

A new job opportunity is exciting, but if it means relocating, selling your home quickly becomes part of the equation. For North Georgia homeowners, balancing deadlines, showings, and moving plans can feel stressful. The good news? With the right strategy, you can sell your home in time for your career move and transition with confidence.

How Do You Sell a Home During Divorce in Georgia?

Selling a home during divorce can feel overwhelming, but with the right guidance, you can move forward with clarity and confidence. If you’re in Georgia and facing this transition, here are key steps to keep in mind.

Behind on Mortgage in Georgia? Your Options Before Foreclosure

Falling Behind Doesn’t Mean You’re Out of Options

If you live in Cherokee County and your mortgage payments are behind, you’re not alone, and you’re not without options. The sooner you act, the more control you retain over your financial future. In this post, I’ll walk you through the choices you have, how they work, and how to decide which path fits your situation.

We are Greg and Jacquee Hart, Local Realtor’s® working with Cherokee County and Georgia homeowners facing tough financial stretches. You don’t have to navigate this alone. We are here to help you see the path forward.

2025 Housing Market Outlook: Prices, Rates, and What to Expect

You’ve seen the headlines, some say prices are dropping, others warn of higher rates. The truth? The second half of 2025 looks more stable than sensational. Let’s look at what experts expect for home prices, mortgage rates, and what this means for your next move.

Why Are More Seniors Downsizing, and How Can You Do It Smoothly?

If you’re thinking about downsizing or moving to a senior community, you’re not alone—and you’re definitely not behind. In fact, according to the National Association of REALTORS®, baby boomers (ages 60–78) now make up the largest share of both homebuyers and sellers nationwide. More seniors are using their equity, simplifying their lives, and showing that moving made easy is possible with the right guidance.

How Can You Buy or Sell a Home That Actually Fits Your Life in Cherokee County, GA?

When buying or selling a home in Cherokee County or North Georgia, focusing only on features like number of bedrooms or square footage can leave you with a house that doesn’t support your lifestyle. Understanding how you live, how you spend weekends, what pace you want, what comfort really means can make all the difference. Below are current market insights, plus advice for buyers and sellers to make decisions that align with your life, not just your wish list.

What Are the Biggest 3 Mistakes First-Time Homebuyers Make?

Buying your first home is exciting, but it can also be overwhelming. In today’s North Georgia market, where homes in Cherokee County average around the mid-$400s to $500s, first-time buyers often face stiff competition and fast-moving opportunities. That’s why avoiding the most common mistakes can save you stress, time, and money.

Here are three first-time buyer missteps I see most often, and how you can steer clear of them.

How Can You Choose a Home That Truly Fits Your Lifestyle?

Too often, buyers purchase a home they think they should want, only to spend the next five years reshaping their routines and preferences to fit a space that never truly worked for them. That’s backwards.

Your home should support the life you’re building, not force you to adjust your passions, habits, or peace of mind. Let’s walk through how I help you flip the script and choose a home that matches your real life.

How I Help Buyers Stay Grounded During Showings (Even When the Backsplash Is Gorgeous)

Buying a home is exciting. You walk into a showing, the light is perfect, the staging feels like a Pinterest board, and suddenly, you can imagine yourself moving in tomorrow. But here’s the truth: beautiful staging doesn’t necessarily mean it’s the right home for you.

As your Real Estate Advisor, one of my most important roles is to help you stay grounded during showings. Let’s walk through exactly how I do that.

When Is the Best Time to Sell Your Georgia Home?

If you’ve been asking yourself, “When’s the best time to sell my home in Cherokee County?” you’re not alone. Timing the market is one of the biggest questions homeowners face. While there’s no single date that guarantees the highest price, understanding seasonal patterns and aligning them with your personal goals can help you sell with confidence.

What’s Happening in the Cherokee County, GA Housing Market? August 2025 Market Update.

The Cherokee County GA housing market in August 2025 is holding strong on prices but showing signs of a slowdown in sales and rising inventory. Detached homes remain resilient, while attached homes face more negotiating pressure. Here’s what buyers and sellers need to know right now.

Cherokee County Real Estate Market 2025: Finding the Sweet Spot

If you’re thinking about buying or selling a home in Cherokee County, Georgia, you’re probably asking: Is now the right time? The short answer is yes , if you know the market’s hot zones and how to price smartly. Strategy matters more than ever, so let’s break down what’s really happening from June 2024 through June 2025.

3 Things to Look Closer At During a Home Tour (That Most Buyers Miss)

Touring homes is one of the most exciting parts of buying. You get to dream, explore, and picture your future in different spaces. But amid all that dreaming, it’s easy to get distracted by shiny features and overlook some key details that could cost you later.

So let’s talk about the three things I always help my clients pay attention to during a tour, beyond just the backsplash and pretty staging.

Trust Your Gut, But Check the Facts When Buying a Home

House hunting isn’t just about spreadsheets and square footage. It’s emotional. You’re imagining your future in every space you walk through. If a house gives you pause, that’s a sign to slow down, not stop, but pause.

Some of my best buyer moments started with that “off” feeling. We went back, asked questions, dug into the disclosures, or scheduled a second showing, and discovered things that changed the whole decision.

You’re not just buying a home. You’re buying peace of mind. That matters.

First-Time Homebuyer? Here’s What No One Tells You (But You’ll Be Glad You Knew)

Buying your first home is exciting, no doubt about it. But it’s also full of things they don’t teach in school. You’re signing up for financial paperwork, negotiations, inspections, and a stack of contracts that can feel like a foreign language.

So let’s talk about what to really expect and how to make it way less stressful.

Your Home Wishlist Is Probably Backwards — Let’s Fix That

When most people start house hunting, they whip out a list: 3 bedrooms, 2 baths, open concept, granite countertops. Sound familiar?

But here’s the thing—those are features. What we really need to focus on first is your lifestyle. Because if you shop for a home based on checkboxes instead of how you live, you risk ending up in a beautiful space that doesn’t fit your real life.